January: a financial wasteland month. All the fun and excitement of Christmas has worn off, and what we’re left with is the financial implications of the seasonal excess.

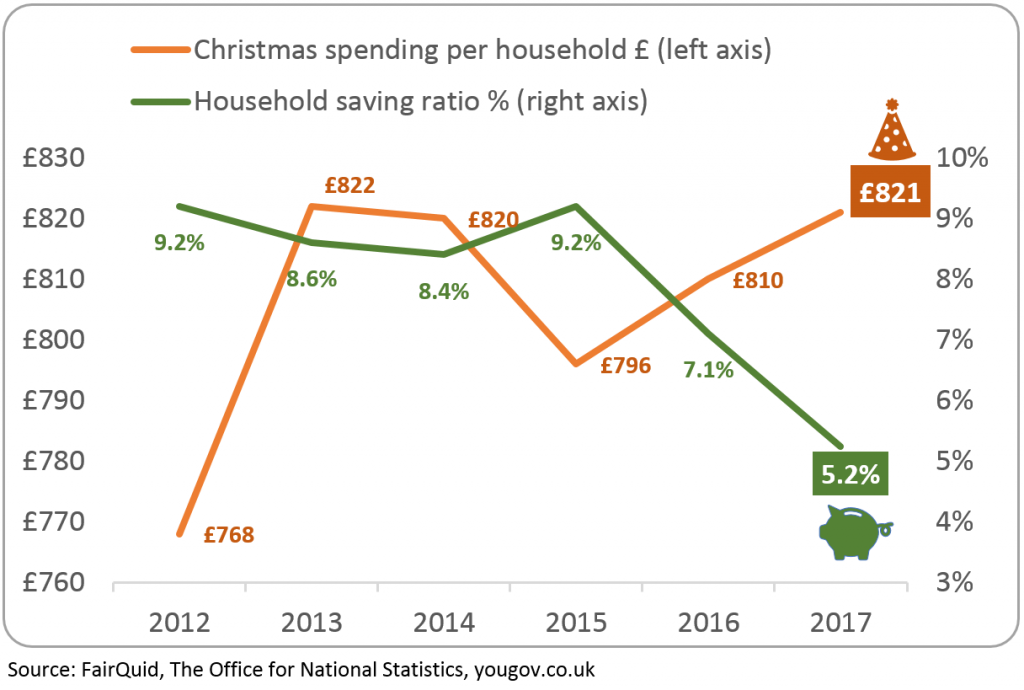

It was expected that last Christmas the average UK adult would spend £243.77 on Christmas presents alone, a 1.4% increase from last year. This figure, of course, excludes the additional costs of the holiday that are often neglected from the gift buying budget, including the dinner with all the trimmings plus the decorations. In total, the Christmas spending was estimated to increase by 1.3% since 2016 reaching £821 for an average family, while the household saving ratio has dropped to a record low level of 5.2% in Q3 2017 (see the chart below).

Most adults also buy more alcohol and nibbles, outfits and decorations than normal – and that’s just entertaining at home, without factoring in those end-of-work parties and pub get-togethers.

Excessive debt everywhere

Once Boxing Day is over, the festivities don’t end: New Year’s Eve and Day are just around the corner, with excess expected into early January. So it’s no surprise that Christmas can hit our wallets hard, despite our best intentions.

Last year it was reported that roughly 50% of Brits would be paying off 2016’s Christmas a year later, and there’s nothing to suggest that the same won’t happen this year. With anxieties about providing the “perfect Christmas”, including satisfying children’s wishes for must-have presents and hosting family events, it’s understandable that we go all out to ensure everyone has a good time. And there are meals out, day trips with the kids, nights out with friends … it all adds up.

But when the party’s over, how can we regain control over our runaway finances – and exert better control over them for next time?

Christmas on credit is becoming alarmingly common, with a third of Brits either borrowing money or buying items on credit to be paid off later. The UK is struggling under an alarmingly high £200bn of personal debt, with 35% of that attributed to credit cards.

Making affordable repayments on these after an exuberant Christmas can often mean paying a minimum sum – sometimes just enough to cover the interest payments, meaning that we’re stuck in debt for longer. Sometimes we can free ourselves from debt just in time for next Christmas, and just in time for new credit spending, and so we find ourselves trapped in a cycle of borrowing and repaying.

With so many credit options to choose from, including store cards, credit cards, and payday loans, it can be tempting to borrow a little here and a little there – which makes it harder to keep track of where the money is going, and how much the interest is adding up with varying APRs.

Consolidation loans

A consolidated loan is a simpler way of managing debt. Once those variable interest cards and loans are paid off, you’ve left with easily-monitored credit: one monthly payment, one fixed rate. With only one monthly outgoing, you’re less likely to miss a payment and incur fees, and, even better, you can have it taken directly from your wage. That way, you’re less likely even to notice the deduction from your monthly allowance (or to accidentally spend it).

FairQuid Credit Union consolidation loans also come with a savings account starting from £10 a month, so even while you’re paying off the expenses of last Christmas, you can be preparing for the next one, or saving for a holiday.

With a savings account, the cost of paying for next Christmas is spread out in advance over the year – but without interest rates to worry about. The double benefits of a consolidation loan and a savings account mean that not only can you pull yourself out of debt, but you’re well-prepared for larger costs, expected (like the Christmas holidays) or unexpected (why do boilers always seem to break down on the coldest week of the year?).

New Year resolutions can often be vague, such as promises to work out ‘more’ and to ‘do better’ with money. To Start Saving with FairQuid is one concrete method of keeping your finances in order. It takes back control of your debt as well as taking charge of your savings, and when it’s all done directly from your payslip, it’s one resolution that is easy to keep.

When you plan ahead, not only can you escape the almost-inevitable sinking into debt to prepare for Christmas, but the holidays themselves become more enjoyable without that pressure of worrying how it will all be paid for later. After all, Christmas is a time for celebration, not for contributing to anxiety about money in the new year. Start Saving today