Everyone likes to save money. We compare our providers before we insure our cars, we shop around for the best mortgages, and we even betray our local supermarket in the hunt for a better deal – all in the effort to save ourselves money.

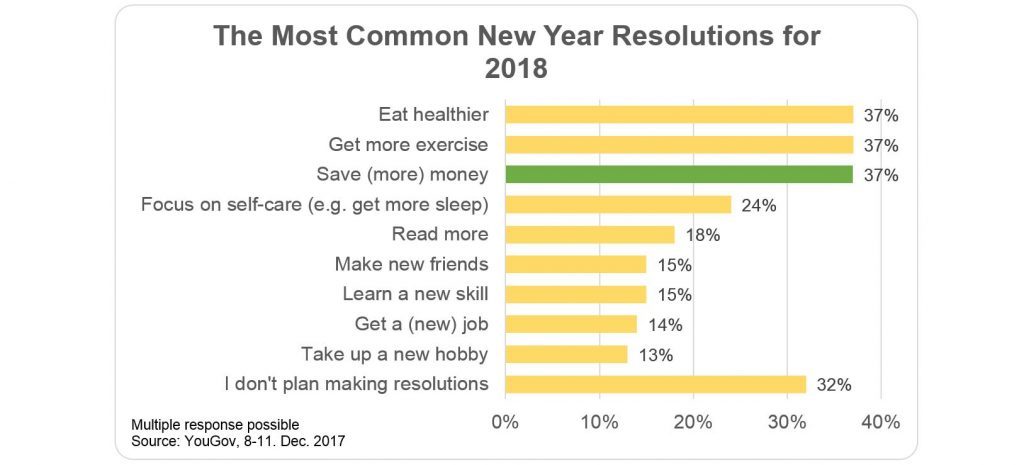

Spending less money is consistently one of the top New Year resolutions, with 37% of us this year citing it as one of our resolutions (see chart below), suggesting that we still believe there’s more to be done to protect us from ourselves. Whether we’re splurging on nights out, restaurants, new clothes, or takeaway lunches, there’s always somewhere we can trim the fat.

But say we swap that Pret a Manger for the bento box? Research suggests that we could save thousands a year by bringing our own meals, snacks, and drinks instead of buying them on the go, between £2,000 and £4,000 and upwards. £4,000 spread over the year is about £333 per month, or £77 a week: not a figure to overlook when trying to save (and, of course, most of us will save a lot less than that, since savvy spenders are unlikely to be spending £77 a week on a couple of coffees and a meal deal). How we find ways to save money is less important than what we do with those savings.

With dribs and drabs remaining in your bank account, it can be tempting to dip into the leftovers for treats, or, even worse, to forget that it’s money you’ve made an effort to save, then only to spend it without thinking. If you’re looking to put money aside – either to hoard for an emergency or to build up for a larger expenditure (e.g. house, new car, holiday) – then you probably want your money somewhere else where you can’t get dip straight back into it.

“Chipping away at your savings can make them not only disappear quickly but seem as if they were never there in the first place”

The logical step is to separate your savings from your spendings. Out of sight, out of mind, right?

Transferring the savings you make to another bank account is an easy way of separating your money. Both current and savings accounts can offer interest on your balance, and there are plenty of comparison sites that can show you the best interest rate. Remember, these may vary depending on the balance, and there may also be other limitations, such as a minimum or maximum deposit.

The most convenient thing about theses current and savings accounts is that they offer easy access to your savings if you need them. However, if you have a specific deadline or goal in mind, then this might not be the best option: if you dip in when you “need” to, then you’re unlikely to see your savings pot grow.

Another option is closed access savings, including ISAs. These also have the added benefit of a higher interest rate, so the more you put in, the more you take out. Your rate will also increase with the length of the term you squirrel your money away for: five years will accumulate more interest than money only going away for one year. Most accounts will allow you to withdraw your money early – but this will come with a fee, and is likely to negate all of the interest you’ve earned so far.

Savers may also be subject to other limitations, such as the minimum amount you can place as an initial deposit, and whether you can add to the pot regularly (via standing order or a transfer when you have some extra funds) or if it only allows a one-time payment.

An alternative to traditional “big bank” saving is credit unions. These collectives originally grew out of a way of helping everyone in the same community – whether that be those in the same area, same profession, or working in the same company. Approximately 1.7 million people in the UK belong to a credit union. These are nonprofits, designed to help everyone, regardless of their circumstances, take control of their finances by saving what they can and borrowing only what they can afford to repay.

Whereas traditional banks use your money to create a profit for themselves and their shareholders, credit unions are based upon the mutual benefits for their members. And the fact that credit unions are protected by the FSCS makes them just as secure as banks.

Credit unions repay their members with dividends rather than interest rates, although some larger unions offer an AER (Annual Equivalent Rate). While banks can only take money that is left over from your wage (whether that’s a fixed sum you’ve decided to transfer in immediately after payday, or whatever’s left over just before), credit unions working in partnership with FairQuid can save your money before it’s even hit your bank account. By taking the money straight from your wage, you can budget what’s left over knowing that you’ve already put aside your savings before you begin spending. For more information on an easier, safer way to save click here.