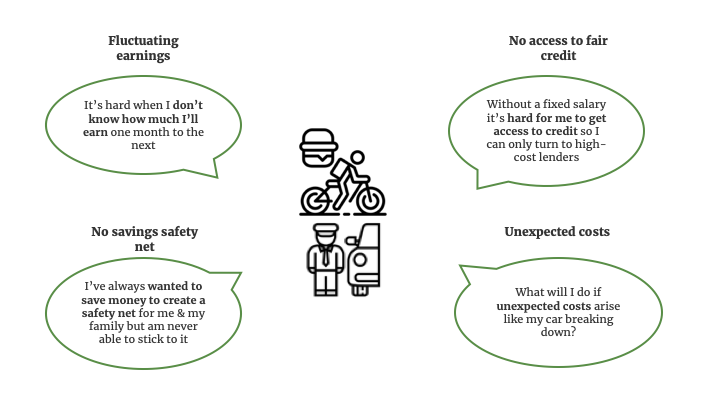

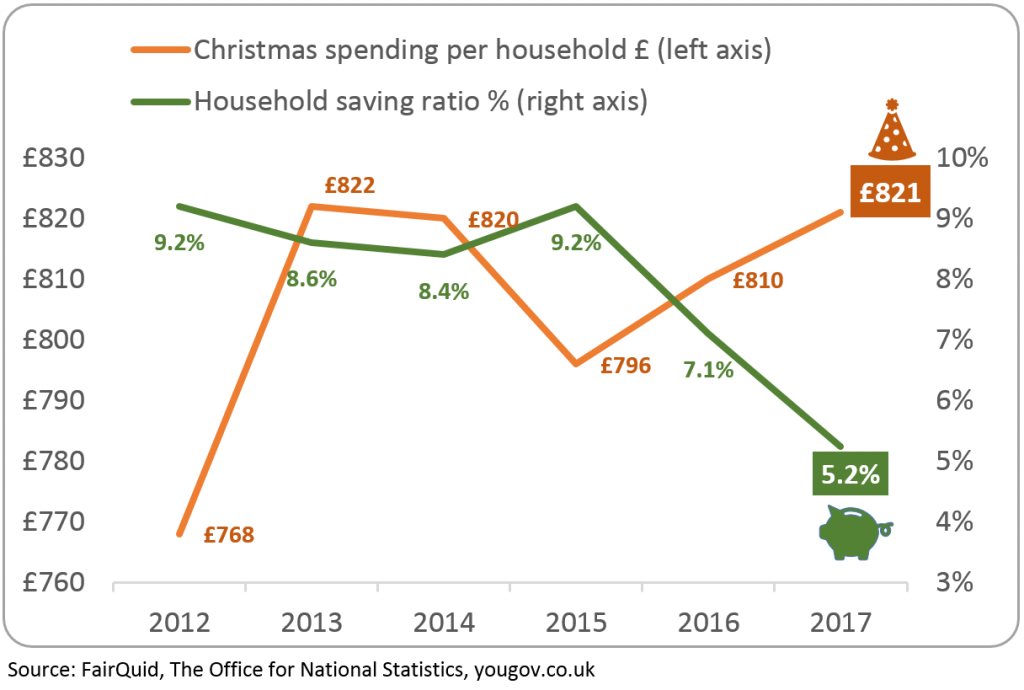

The United Kingdom is reeling under a personal debt crisis, unprecedented in its scale. There are a disturbing number of statistics on the financial fragility of UK household finances. There clearly is a pressing need to address this financial vulnerability. There seems to be a weakness in money management skills, including anticipating bills and budgeting among people in general.

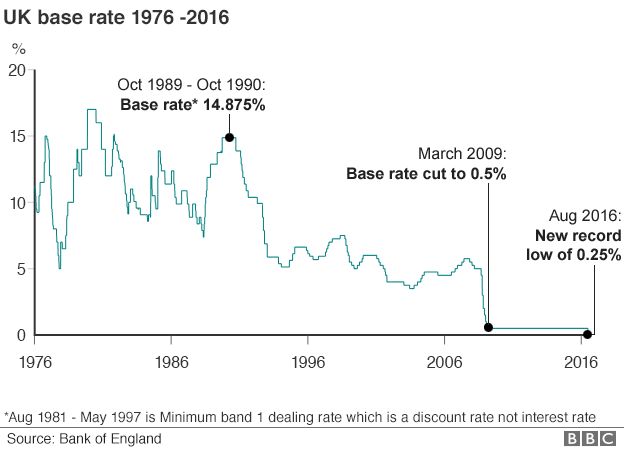

After the Christmas excesses, millions have come face to face with the cost of the celebrations as the credit card bills came through the letterbox on Blue Monday, traditionally dubbed the most depressing day of the year. According to Professor John Jerrim, of the UCL Institute of Education, “There’s a direct link between basic financial literacy and being able to make big financial decisions, such as knowing the implications of getting a mortgage with a certain interest rate.”

Data compiled through the Programme for International Assessment of Adult Competencies (PIAAC) in 2011, show that England and Northern Ireland are facing a “crisis” in financial literacy skills, as research reveals that one in three people cannot work out the correct change from a shopping trip. This lack of financial literacy in the UK has been found to be correlated with higher debt burdens, incurring greater fees, loan defaults and loan delinquency.

Financial education programmes aiming at money management skills could be effective in reducing debt. Personal financial management software, behavioural finance literature as well as financial education need to be employed to encourage budgeting and saving.

According to a report commissioned for Talk Money Week, 77% of UK citizens said they did not or could not recall receiving any financial education at school. Most payday borrowers cannot accurately recall Annual Percentage Rates (APRs) despite having the ability to report finance charges, suggesting that most borrowers consider charges rather than APRs in making borrowing decisions.

A major part of financial education includes understanding the value of money. It is vital that individuals realise that financial education offers incredible value for them as it has the potential to treat the underlying cause of under-saving and high reliance on debt. Here, two things need to be called out, one, some of the responsibility for ensuring employees have received or have access to basic financial education should lie with the employers – this is because it is they who end up bearing the impact of their employees money concerns in the form of loss of productivity and lack of engagement in the workplace. One underused resource for financial support is Credit Unions, which may just have the answers. The second thing that needs to be acknowledged is that this education needs to be more than just a checkbox exercise. Just providing access to material or videos in the form of education may not work for everyone. People learn differently and have different triggers, this education needs to be delivered in a way that it is personalised, relevant and timely in order to maximise engagement and uptake, and therefore, the resultant benefit.

Credit Unions are important players in national financial literacy strategies. They have a core operating principle of financial education, but this is primarily restricted to low-commitment activities with marginal impact. What is required is a well-structured programme, that could focus on money management skills and constitute an effective financial education strategy for those in distress. The FairQuid Wellbeing Platform is structured in a way that is based on personas and triggers,and it delivers personalised and relevant content to each user when they would respond to it. Technology is used to personalise the experience and hence, drive engagement with the content. It can help people learn healthy financial habits while supporting them in times of need.