Loans, store cards, credit cards and mobile phone contracts seem like a great idea when you are in a happy relationship.

But when things go wrong, which can happen at any age, monthly payments can turn into hazardous liabilities that can trip you up years later. Taking out credit – which includes phone contracts – for someone else is always risky, even when you are married.

Even if someone else is giving you the money to cover the payments, the debt is still yours. You are legally responsible. One such example is a guy who used his good credit score to get a phone for his girlfriend at university. Let’s call him Andrew. He took out a 12-month contract for her, but six months later, they broke up, and both of them moved to different flats.

A Series of Unfortunate Events

All of the bills were going to their former address. He didn’t change the billing address, and she stopped paying him. He wrongly assumed she would take over payments – which anyone can do, even without access to the account or needing to pass security questions. Maybe she did for a while, but at some point, she stopped paying, and he wasn’t paying anymore.

It took another six months for the debt to catch up with Andrew. When it did, it was over £150, including late payment charges and collection agency fees. He paid it and assumed the situation was dealt with. It was hard enough breaking up with his girlfriend, never mind the added pain of paying off her phone contract.

He was wrong to assume the debt situation was over.

Six years later, after climbing his career ladder, promotions and stable employment, Andrew’s credit has finally recovered. It has taken six years of being careful with money and not being able to get much credit for the one ‘black mark’ to stop affecting his ability to get loans, credit cards, store cards and a mortgage.

Making Sense of Credit Scores

Andrew is not alone. Millions of people – for one reason or another – have limited access to credit as a result of bad scores preventing us from accessing finance many of us can, on current salaries, easily afford.

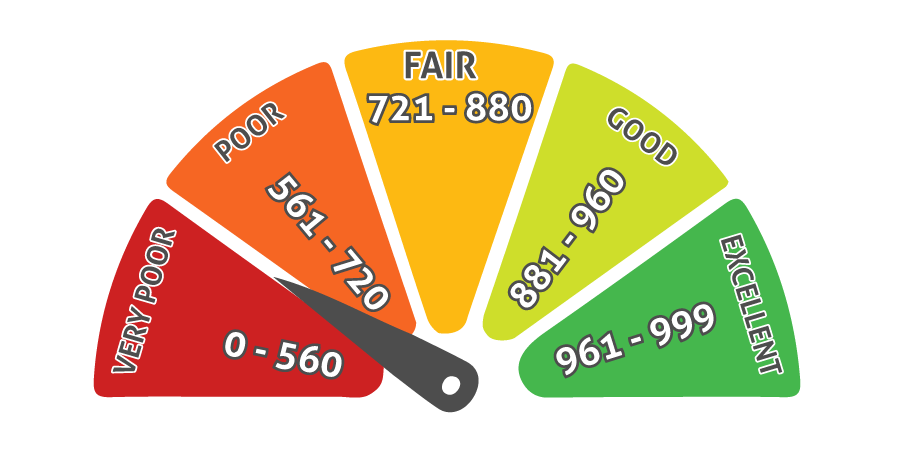

For many people, credit scores are like a black box. Black boxes constantly record numerous data inputs on planes. In the same way, credit reports record data from numerous sources: our bank accounts, credit cards, phone companies, utility companies, store cards, mortgages, and any applications to apply for more credit.

Most of us don’t know our credit scores. However, you can find out easily enough – using ClearScore (free), Experian (free trial – but remember to cancel) and other free tools. But if you don’t know, yet want to apply for something, such as a loan or credit card, you run the risk of damaging your credit further thanks to marketing from banks and other companies that suggest you will be successful.

Aggressive tactics and offer target those most vulnerable, and more likely to need credit quickly. When people are denied, it can be tempting to try payday lenders, and others that offer money at an extortionate rate. When your credit has been damaged, but you are rebuilding, and in steady employment, payday lenders should not be your only option.

There is an alternative solution, thanks to FairQuid: Your Wages Your Way. If you’ve been employed for at least one year at your current employer, you can apply for a loan through credit unions that take employment history and salary into consideration.

We don’t base everything on credit scores. You also get an automatic saving account as part of this loan: starting from a minimum of £10 per month, with payments for both coming directly from your salary, making budgeting easier. All your employer needs to do is verify your employment and adjust your payroll if you are approved. It doesn’t cost them a penny. Find out more and apply here.