The concept of work today is changing. One key trend making waves is the concept of freelance or contract-based work, also known as the gig economy. A departure from the full-time employment, a gig is a temporary work engagement where the worker is paid only for that specific job.

According to the McKinsey Global Institute [1], there are 5 million people currently working in the gig economy in the UK, which is around 15.6% of the total full- and part-time workforce in the UK (32 million). The flexibility that this trend offers the individuals is what makes it so attractive, especially for those who do not want to, or for some reason cannot, work full time; while the businesses find the gig-based system to be more cost-effective and efficient.

Many of the current work profiles can easily be transformed into gig economy contracts. Some of them are obvious, such as couriers, delivery staff, drivers and manual labour; while others may not be as obvious, such as part-time teachers and healthcare providers. According to the Office of National Statistics[2], most of UK’s gig workers are in London. Around 27% of the capital’s workforce is employed on a gig basis (17% are self-employed and just 13% are employees).

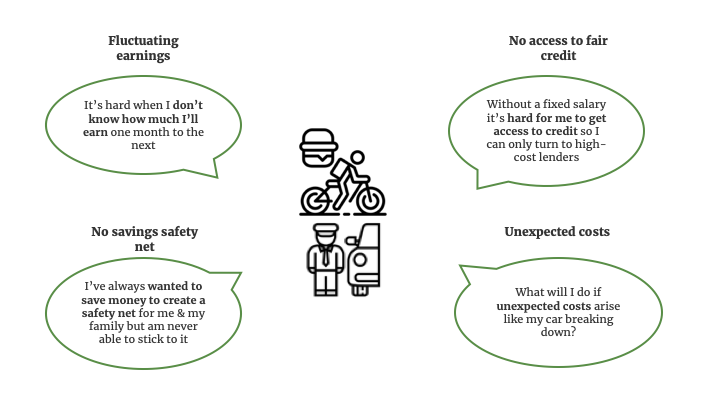

While it is a given that people who are working as independent contractors benefit from the ability to quote their price on the project of their choice, there are some obvious pitfalls as well. One of the biggest one is, of course, the lack of job security and continuity. Also, as gig workers are not recognized as employees, they are not eligible for workers’ rights and benefits such as sick leave, holiday pay, maternity leave, etc. In fact, they are not even assured a minimum wage.

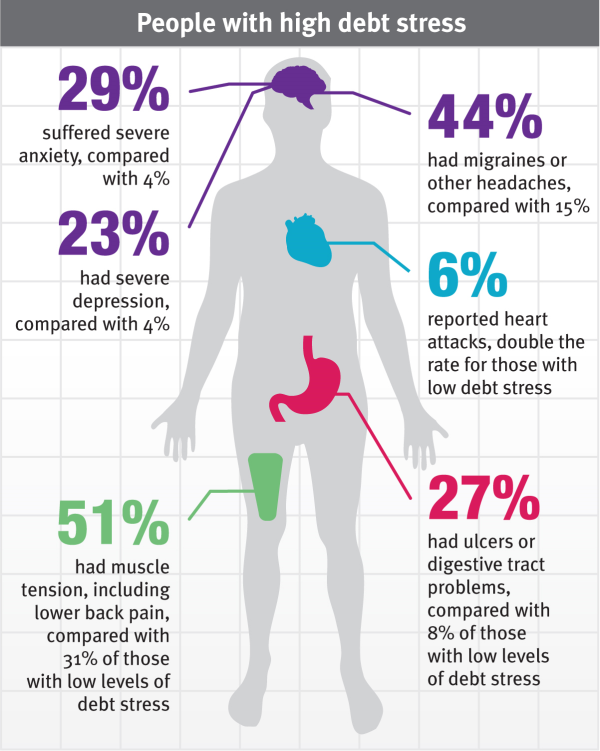

This is a disturbing development, taking into the account the fact that the UK is currently facing a consumer debt crisis. The average UK family now owes £15,385 in unsecured debt, including credit cards, loans and overdrafts. According to the Trades Union Congress, the total amount owed rose to £428 billion in the Q3 2018. That means each household owed £886 more than a year earlier. [3]

Another disturbing sub-trend developing in relation to the gig economy is regulatory in nature. As gig workers are not recognized as employees, they are, therefore, cut off from the ‘benefits’ that go hand-in-hand with full-time employment. As a result, many gig companies are facing legal issues. Addison Lee, a car and courier business, has come under a lot of scrutiny in the UK for claiming that their drivers are not employees but self-employed and are not entitled for employee benefits. Deliveroo, another gig company, faced riders’ strikes after the company announced plans to replace their hourly rate with a payment per delivery[4].

Such examples clearly point to the fact that financial security is top of mind for individuals.

Recognising this need, companies such as Addison Lee and Deliveroo have now started to evaluate alternatives that allow them to improve engagement with their workers as well as benefits that go with the gig they signed on for. For example, Deliveroo is set to equip its 35,000 riders with free accident insurance worth £10 million. The flip side to this move is that the company risks labeling its self-employed workers as staff. However, if regulations allowed for benefits to gig workers, then many companies would certainly be exploring additional options. According to Deliveroo’s CEO and founder Will Shu, “We would like to go further, but are currently constrained by the law.”

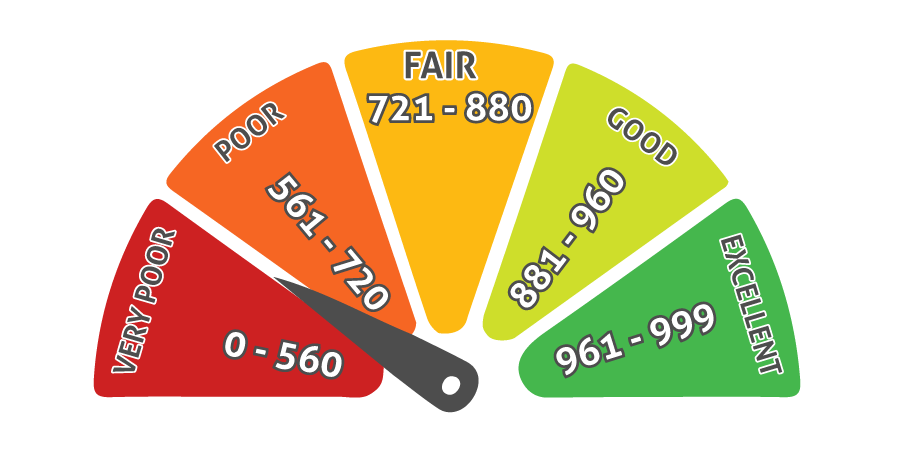

One thought that needs further deliberation is that for a gig worker access to mainstream financial products is limited considerably, since old credit models don’t treat a gig worker in the same light as a full-time employee. Even if they have a good history of earning and stable income, their options get reduced and costs are driven up if they have to access funds in need. Additionally, the variability in income makes it difficult to stick to regular savings as income may be flexible but expenses are not.

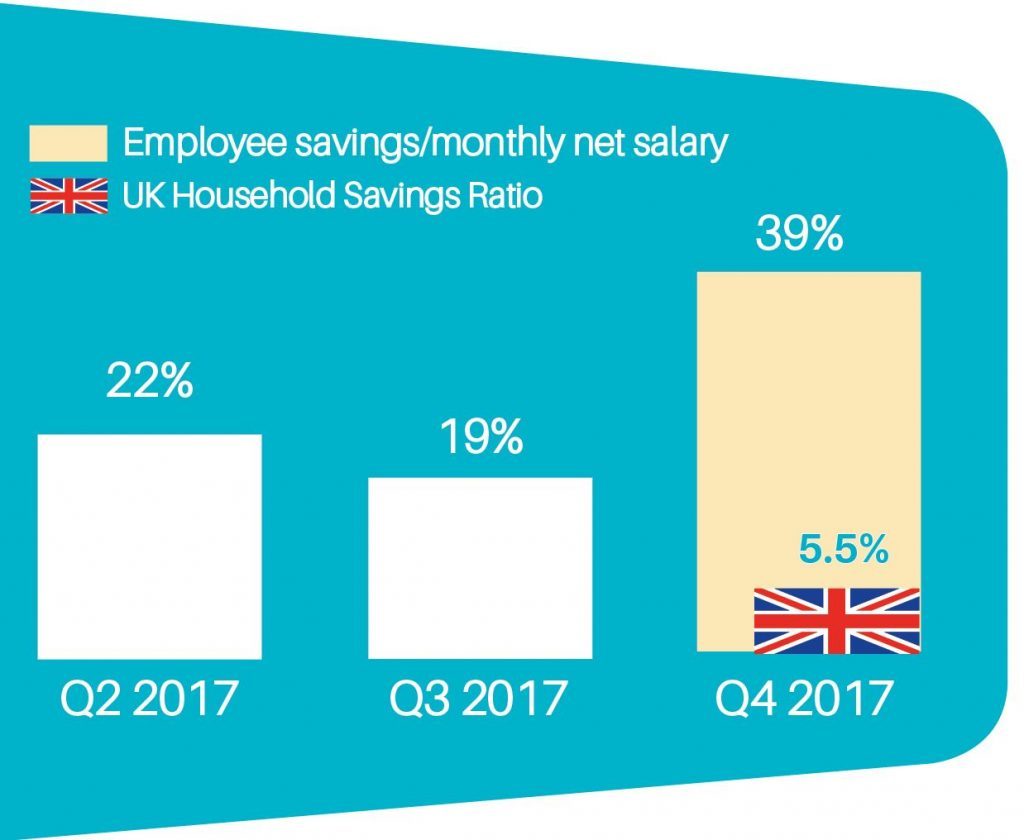

In such an ecosystem, it is interesting to note that the number of gig workers in the UK economy are only set to grow. As per numbers shared by RSA Insurance [5], 18% of the workers in the UK would be open to gig work – that is roughly 7.9 million people prepared to make this leap. With the number of people moving from fixed income to variable income career options, there is a pressing need for a solution to address their financial needs and at the same time empower them to get into the habit of saving for a rainy day.

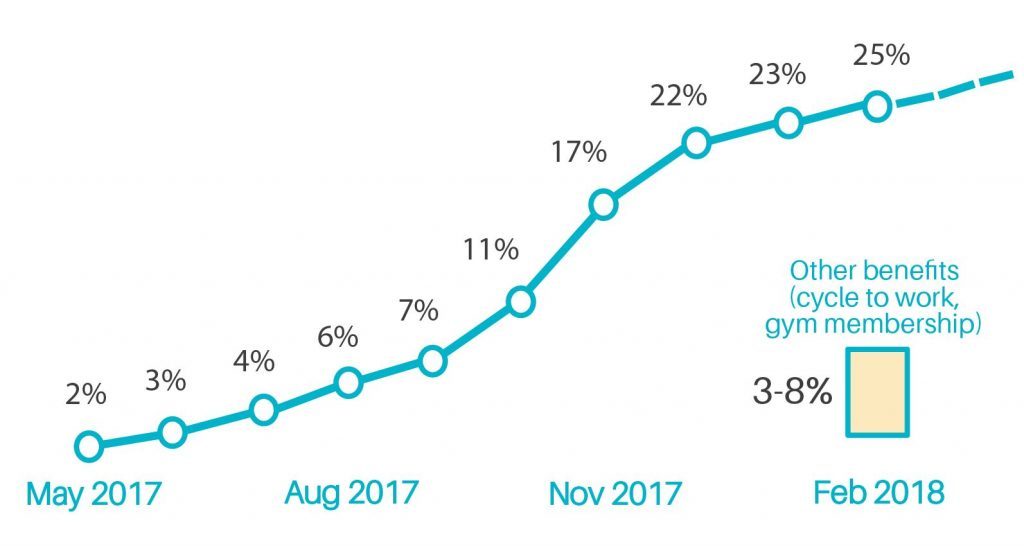

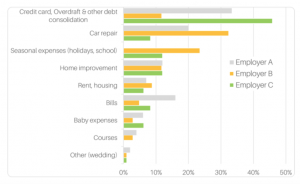

The FairQuid Wellness Platform may just have the answers. Having partnered with Credit Unions, FairQuid offers people an alternative access for emergency funds as well as a flexible way to save regularly – using the work history and performance as current and forward-looking credit risk indicators, rather than conventional financial parameters. In the context of the gig economy, FairQuid would tie up with gig companies to offer their self-employed contractors this innovative financial solution. They would receive financial and educational tools to take better finance-related decisions with regards to initiating savings and have ethical access to funds, if needed.

On Demand platforms will benefit by not only generating immense goodwill among the contract workers, but also proactively preventing financial security-based mental health issues and boosting engagement levels. They will also be benefitted by increasing stickiness of their platforms as they would have converted individual’s platform data into a credit currency for them.

[1] https://www.thesun.co.uk/money/3985964/gig-economy-pimlico-plumbers-uber-amazon/

[2] https://www.premierline.co.uk/knowledge-centre/the-gig-economy.html

[3] https://www.express.co.uk/news/uk/1068877/debt-crisis-uk-families-credit-cards-overdrafts

[4] https://www.thesun.co.uk/money/3985964/gig-economy-pimlico-plumbers-uber-amazon/

[5] http://www.smeweb.com/2018/05/31/gig-economy-changing-uk-labour-market/