Stuck in Persistent Debt: Want a Way Out?

More people than perhaps anyone realises is stuck in “persistent debt”, according to the financial watchdog. Around 3.3 million people are stuck in a cycle of only ever paying the minimum on credit cards and loans, with more money being paid out on interest...

Why Credit Unions Are The Future of Employee Financial Wellbeing

Consumers lost confidence in mainstream banks as a result of the recession. Mortgage foreclosures, PPI, tighter lending criteria and rejected loan applications crippled millions of families and businesses when they most needed help.

At the same time,...

Lending Money to Staff: Pros and Cons?

We aren’t born worrying about money, as Yorkshire Bank likes to remind anyone who uses their cash machines.

And yet, for the majority of adults in the UK, money worries cloud our waking thoughts – and troubled nights...

Do Employees Care About Workplace Perks?

With growth at 2% and unemployment at 4.8% in the UK, we might be forgiven for thinking the recession is receding into memory. And it is, for the most part. Except for the impact recent economic history is still having in the workplace.

...Debt and Economy Damaging Careers and Earnings of Millennials

Our economy is growing, but that doesn’t mean we have seen the last of the recession. It continues to exert an influence on the prospects and earnings of professionals who started their careers during the recession.

Millennials...

What To Look Out For When Employees Are Struggling With Debt

Despite Brexit inspired fears of an economic slowdown, the British economy keeps growing, with recent forecasts from the Bank of England, European Commission and IMF reporting positive upgrades for 2017.

Business and consumer confidence remains healthy, even optimistic....

How to change bad financial habits & improve financial wellbeing

Vulnerability – historic low levels of savings in the UK

With interest rates at a historically low level (base rate reduced to 0.25% in summer 2016) spending helped the British economy to tackle the Brexit vote shock, and on national level provided a positive impetus for growth. This resulted in...

Turning Employee Financial Wellbeing into Action

Many working Brits are living with an unnerving financial uncertainty, despite the majority having stable jobs with an income much higher than the national minimum wage. Low levels of savings and the lack of long-term financial planning exposes households to seek quick fixes...

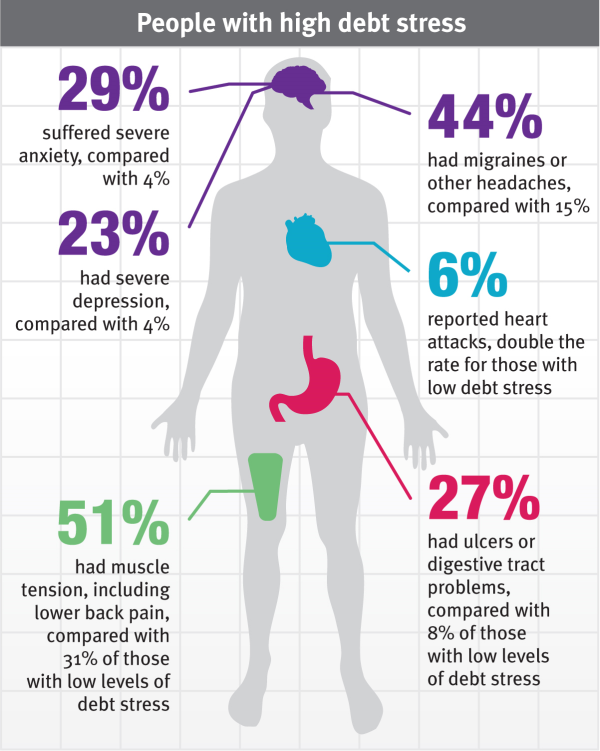

Impact of Employee Financial Stress on your Bottomline

Employee Stress

Recently came across a well-researched post in America about the impact of employee financial stress and its impact on company’s bottom line in real dollars and cents. You can read the whole post and the sources of...