Mental health awareness is at a tipping point. More people than ever are talking about mental health, sharing stories, seeking help and realising that the stigma around it needs to be broken.

Celebrities and royals are making a significant contribution to changing the national dialogue on this subject. Only recently, Prince Harry and the Duke and Duchess of Cambridge launched the Heads Together campaign, alongside national mental health charities. As part of raising awareness, Prince Harry finally spoke out about his grief over losing his mother, Diana, Princess of Wales in 1997, when he was a child.

Heads Together also enlisted celebrities, including Lady Gaga, Professor Green, Stephen Fry, Rio Ferdinand, comedian Ruby Wax, and former England cricket captain, Andrew Flintoff. Other celebrities, from the boxer, Frank Bruno to Benedict Cumberbatch have also spoken openly about everything from depression to bipolar and other mental illnesses, all supporting the movement to break through the stigma.

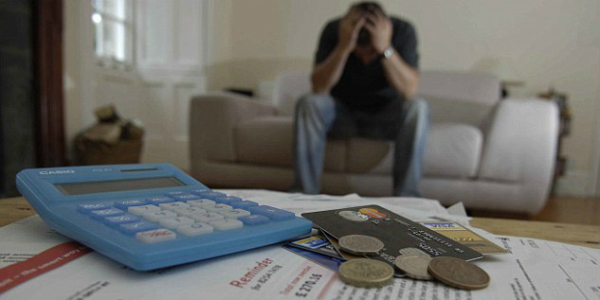

Men, in particular, can’t afford to stay silent when they are struggling. Suicide is the biggest killer for men under 45. Money, especially when you don’t have enough, can play a huge role in anyone’s mental health.

Overburdened with Debt

Not having enough money, those stuck in persistent debt, or being hit with an unexpected bill – boiler or car breaking – can negatively affect people’s mental health, making it harder to focus on work and manage your finances.

Right now, average household debt is over £13,000 (which includes student loans but does not including mortgages). Recent figures from the Bank of England show unsecured consumer debt – credit cards, loans, overdrafts, car finance and second mortgages – now totals £240 billion.

Some people can more easily afford debt, can juggle credit cards without worry. But not everyone can. Within this massive national debt, there are 3.3 million customers paying £2.50 for every £1.00 borrowed, according to the Financial Conduct Authority (FCA). The FCA wants the financial sector to tackle this issue, to help those with too much debt, but enforceable guidelines won’t come out until 2018.

At the same time, not enough people are saving money. According to debt charity, StepChange, if every household had £1,000 as a rainy day fund – which is less than the three to six months financial experts recommend – it would reduce the risk of 500,000 families falling into short-term ‘problem debt.’ Despite this sound advice, less than 40% have £100 set aside and around 70% of households don’t have a full £1,000 set aside.

Money and Mental Health

Studies show that worrying about money reduces mental capacity, comparable to losing 13 IQ points. Trouble concentrating is a clear sign someone is struggling with their mental health, which is made worse – or could be caused by – financial stress.

Exhaustion, irritability, poor diet, too much or not enough sleep are other signs that someone needs help or would benefit from talking about their problems. Anxiety and stress can also present as physical symptoms, including shaking, sweating, nausea and panic attacks. Sometimes speaking to a loved one, a friend, colleague or therapist can make all the difference.

Taking action, to get finances in a better position is equally important. Whether that means borrowing from friends or family – or your employer if they offer employee benefit loans – or saving some money after incurring an unexpected bill would help avoid a similar situation in the future. Banks, credit unions and various charities offer financial advice counselling, which can help; but for many people, talking to others and taking action is the most effective way to turn a financial problem around.

Need mental health help now? Numbers to Call:

Samaritans: 24 hours a day, 365 days a year. Call (FREE): 116 123 (UK) or 116 123 (ROI)

MIND, the mental health charity: Website or call 0300 123 3393

Rethink Mental Illness: Website or call 0300 5000 927