Despite Brexit inspired fears of an economic slowdown, the British economy keeps growing, with recent forecasts from the Bank of England, European Commission and IMF reporting positive upgrades for 2017.

Business and consumer confidence remains healthy, even optimistic. Fears of recession are receding in people’s minds, replaced by new fears, such as what chaos US President Donald Trump might unleash on Twitter today. Unemployment is currently at 5.4%, with businesses continuing to recruit new staff, grow and invest. At the same time, consumers are borrowing at a rate we have not seen since 2008.

The most recent figures from the Bank of England show unsecured consumer debt – credit cards, loans, overdrafts, car finance and second mortgages – grew 10.8% in November 2016, totalling £192.2 billion.

Peter Tutton, head of policy at the debt charity, StepChange, pointed out that net lending is growing at rates not seen since 2005. Speaking to The Guardian, he said: “Alarm bells should be ringing.” When student loans are thrown into the mix, average UK household debt reaches £12,887, according to the Office for National Statistics (ONS) and TUC.

Are Consumers Saving?

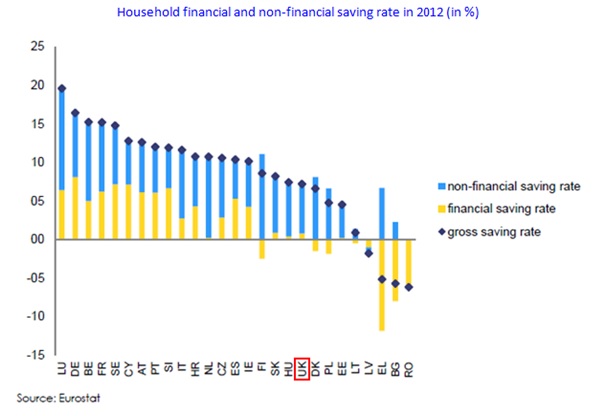

Confident consumers don’t save, they spend. Historically low-interest rates are also partly to blame. Not only is money cheaper to borrow, but saving it generates miserable returns. When an economy is strong, savings fall. They are currently at 5.6%, according to the latest Bank of England figures from Q3 2016.

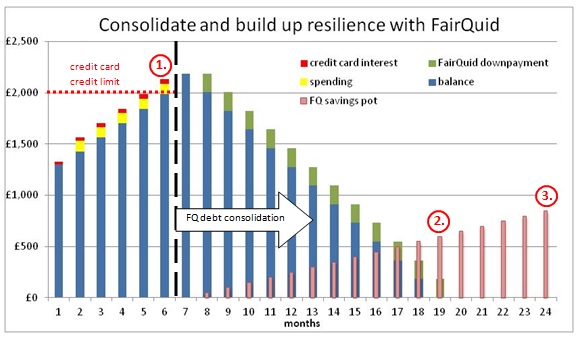

According to StepChange, if every household had £1,000 as a rainy day fund – which is less than the three to six months financial experts recommend – it would reduce the risk of 500,000 families falling into short-term ‘problem debt.’ For many households – especially those earning decent money – it is easier to take out another credit card than saving.

When Debt Becomes a Problem

Debt is everywhere. Managers and highly-paid professionals have debt. Business owners can’t assume that their staff aren’t struggling with finances as a consequence of comfortable salaries. Higher pay makes it easier to borrow, which in turn, reduces the desire to save and keep a rein on outgoings. When money is flowing freely, now is the time to get into good savings habits, which is also something employers can encourage.

Employers can’t tell employees what to do with their money, but they do have a duty of care that extends to personal and financial wellbeing. An unexpected expense, changing circumstances – such as divorce or a suddenly unemployed partner – and bills getting out of hand can soon push people into tricky financial circumstances. It can happen to anyone, especially when there is no buffer to cushion the blow.

Watch out for warning signs. Bad and unexpected debt can impact productivity, employee morale, causing absences, sick days and stress. Here are a few things managers and colleagues should look out for:

- Changed circumstances: especially new expenses or reduced household income (a relationship or marriage breakdown) – not reflected in lifestyle choices. If someone is living the same way – going out and splashing cash around – they could risk getting themselves into unmanageable debt.

- Exhaustion, irritability and stress: We spend a lot of time with our colleagues. People notice when team members are mentally and physically drained. Bad moods, lack of sleep and exhaustion have many causes, but financial worries are always worth asking about, providing this is done sensitively.

- Poor diet: Financial anxiety is another reason people comfort eat, sleep less, drink more, and stop taking care of themselves.

- Anxiety, anger and an inability to concentrate: Everyone reacts to stress differently. Some may withdraw, whereas others get angry, or can’t concentrate at work, which is unsurprising when studies show that worrying about money reduces mental capacity, comparable to losing 13 IQ points.

No one wants employees to suffer without offering some intervention and help. There are several solutions, from training to practical interventions, such as the ethical loans we provide through our platform to savings accounts, which is also something we can offer employees. When it comes to saving, small change soon adds up. Providing any assistance is offered sensitively, and the help is received willingly, an employee can get unexpected costs back under control without extra stress or being forced to pay ridiculously high rates that only make a situation worse.

Sources:

1. The Guardian: https://www.theguardian.com/business/2017/jan/04/uk-credit-cards-borrowing-debt-economic-crash-fears

2. ONC and TUC figures in the BBC: www.bbc.co.uk/news/business-38534238

3. B of E savings figures: www.economicshelp.org/blog/848/economics/savings-ratio-uk/

4. Princeton study on debt and cognitive impact: www.wired.co.uk/article/worrying-about-money-can-lower-your-iq