Our economy is growing, but that doesn’t mean we have seen the last of the recession. It continues to exert an influence on the prospects and earnings of professionals who started their careers during the recession.

Millennials – those born between 1984 and 2001 (also known as Generation Y) – in the UK ended up with the short end of the financial straw. Around the same time – the early 2000’s – the economy was ballooning into a bubble; Generation Y was being sold the dream of earning a degree and walking into a high-flying graduate job, with signing bonuses, cars, and benefits. Then, in 2008, the recession hit.

Dream jobs for graduates became scarce. Young people, used to their own freedom, were forced to return home. A bleak reality sunk in, with dreams put on hold and a younger generation taking any job they could get, from zero hour retail contracts to low-paying freelance gigs. No one expects to graduate from three years of study with a first or 2:1 only to return home and work at Burger King, but for some, especially those who aren’t from privileged families, that is what happened.

Although the recession is over, it takes millennials even longer to get on the housing ladder. Savings are frighteningly low amongst this generation. And debt is high, thanks to student loans, overdrafts and credit cards. But the recession has had a more subtle, yet ultimately more damaging impact on the career prospects of millennials.

Lower Career Confidence

Millennials are – incorrectly – considered fickle and loyal only to themselves. Partly thanks to social media, the “oversharing” generation appear quick to change partners, university courses and jobs. However, a recent study by the Resolution Foundation has found that workers born in the mid-1980s are half as likely to switch jobs as those born in the previous decade. Only 25 percent of millennial professionals regularly job hop, in stark contrast to one of the career stereotypes of that generation.

Wages are also stagnant for younger generations, making it harder to pay off debts or save for a deposit. Perhaps unsurprisingly, many who weren’t able to find work after graduating went self-employed, which comes with other risks and rewards.

For those in employment, “One of the most striking shifts in the labour market has been young people prioritising job security and opting to stick with their employer rather than move jobs,” said Laura Gardiner, a senior policy analyst at the Resolution Foundation.

Can Employers Support Millennials More?

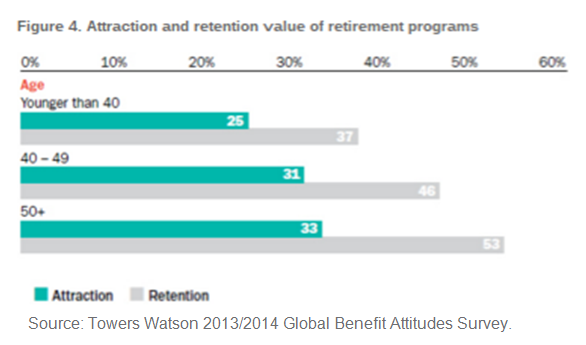

Through no fault of their own, Gen Y employees entered the labour market at the worst possible moment. For many, this slowed down, derailed or resulted in entirely new career plans and pathways. It also made this generation of professionals more cautious. Consequently, they don’t take as many risks, which is why they place a higher value in job security, skills development and reassurance, in the form of praise and feedback, more than previous generations.

However, with unemployment lower than ever – at 4.8% – we know this situation is already starting to change. Younger workers are eager to get on the property ladder. Perks and benefits are great, but millennials prefer salary increases, bonuses, commission or another form of financial reward. Employers should not depend on loyalty when they are only handing out “soft” incentives, such as training, flexitime and Friday treats, like pizza and cake.

One of the biggest financial challenges for younger workers is debts and savings. Too much of one, not enough of the other. Pizza and cake will not keep staff loyal forever when they need to clear debts and pay deposits. However, you don’t always need to give millennials a raise to solve these issues.

Instead, we can provide long-term debt consolidation and savings accounts from ethical lenders through our platform, making it easy for you to help them repay debt responsibly and save for a brighter future, without costing employers anything. Now that is an employee benefit your staff can take to the bank. Find out more today.

Sources:

CIPD: http://www2.cipd.co.uk/pm/peoplemanagement/b/weblog/archive/2017/02/23/job-loyalty-denting-millennials-pay-and-careers-report-finds

CV Library research: https://www.employeebenefits.co.uk/issues/january-online-2016/85-would-opt-for-a-pay-rise-or-bonus-over-workplace-perks/