Employee benefits are increasingly popular and we frequently hear about this new high tech start-up that offers unlimited holidays, stock options or discounted travel tickets.

All these perks sound great on paper but do they have a real impact on staff motivation and retention, if your company is not Uber or Virgin and you don’t have a workforce made of 25 year old computer geeks?

In a recent study on employee wellbeing* Barclay’s highlights the employee benefit disconnect where 72% of employers are confident they provide a good benefit package but more than 78% of employees disagree.

Two main factors can account for this strong discrepancy:

1. Chasm between benefits offered and needs of your employees

2. Communication on benefits available to the employees

Chasm between benefits offered and needs of your employees

For your employees to commit to your company goals, and go the extra mile, to make sure that they are achieved, the very first thing that comes to mind is, for you to go the extra mile for them. Get in their shoes and see what challenges they face in their daily lives. Create an ecosystem where they can focus on work and not have others worries occupying their minds. Maybe a good way to evaluate benefit packages could be to go back to basic concepts and compare what needs you’re satisfying on a Maslow Pyramid and where your employees actually stand on this scale.

1. Physiological needs

2. Safety

3. Love/Belonging

4. Esteem

5. Self Actualization

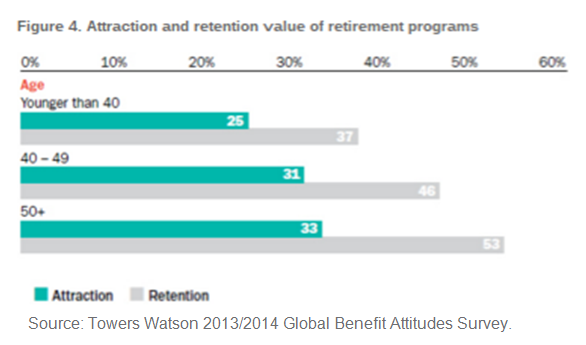

In a developed economy, like UK, one would expect all people to rank high in Maslow hierarchy of needs. While physiological needs are mostly covered, the need for safety (financial) is often not entirely fulfilled. Living in a stable and predictable environment is an essential feature that your employees look for. Several benefits exist and the most famous are healthcare and retirement plans. While these benefits are attractive to 40+ y/o employees, their impact on younger staff is far less significant.

According to Barclay’s Study, 40% of UK citizens have less than one month’s savings and make attractive business for loan sharks (payday lenders and credit card companies). How could your employees be engaged and focus on work when they lose sleep at night, because they don’t know how they are going to pay their bills or fund an unexpected expense? Employees don’t leave their financial issues and stress at the door, when they come to work in the morning.

Salary increases and company lending are not viable options. In a competitive environment a few percent raise in salary has little to no real impact on employee’s well-being but can be enough to wreck an organisation’s finances. That’s when smart benefits come into play; to implement benefits that will be adapted to the specific needs of your employees and sustainable for your company. Employee financial health is probably the most significant area for HR managers to focus on, but there are many more.

HR managers are key to assess what employees need, to deliver their full potential for the greater good of the company. They are also responsible for its successful implementation which can’t happen without a full commitment from the HR team.

Communication of your benefit package

For a benefit package to succeed within the company, HR managers must support it actively. Regardless of whether the benefit package was tailored at the company or purchased from a benefit provider; HRs are the key to massive employee adoption of any benefit package. If HRs don’t actively support and promote it, it will not be successful no matter how good it is for employees. Communication tools exist and can be used to set up active long term promotion campaigns. Some ideas:

– Common advertising: posters, leaflets

– More advanced advertising: company internal meetings, newsletters, visibility on intranet, case studies & employee feedback

– A benefits portal with easy access online 24x7x365

Being seen is not enough. Make sure your benefit package is easily available and enrolment is hassle free and convenient. The interface is key: Thaler and Sunstein showed in Nudge# that the interface determines the behaviour of people. Let me give you a very basic example. At a company/school cafeteria depending on how food items are arranged you can increase or decrease the consumption of any food item up to 25%. This experiment is a good illustration of the Nudge theory. In other words, how you can influence healthy behaviours through the choice interface you’re offering to your population. In the employee benefit area this theory was implemented in the US as suggested by the Save More Tomorrow program where employees monthly retirement savings contribution is automatically raised every time they got a pay raise unless employee logs in and cancels the automatic raise in his monthly salary deduction. In its first implementation, the Save More Tomorrow program helped boost the average participant’s 401(k) savings rate from 3.5% to 13.6% in just 3.5 years. People want to save more but they just don’t have the reflex to do it. Save More Tomorrow nudges them to increase their savings and lets them free to do otherwise if they don’t want to.

As we said retirement plans are good ideas but not enough to retain all workers that might be focusing more on the present rather than on their retirement strategy. In the UK, there is the example of Credit Union^ payroll deduction schemes. They are great opportunities for employees to get back on track with their finances by having access to affordable and healthy lending and a strong incentive to save money every month. However, very few employees join Credit Union payroll schemes because of lack of convenience and user-friendliness: the interface is just not right.

– Credit Unions only lend to members (with at least 3 months or greater membership history) but usually people only think about joining when they need a loan.

– Plus, even if your company has a payroll scheme with the local Credit Union, you still have to mail documents or show up physically at their local office.

– So people end up going online to payday lenders or using credit card debt even if it is more expensive and they can’t afford it, but it is convenient, quick and easy.

WEC Group a Lancashire-based metal fabrication company is one concrete example of how understanding the Nudge effect and optimizing the user interface can dramatically increase employee adoption of a new benefit. WEC had a payroll deduction scheme with Jubilee Tower Credit Union but uptake from employees was not that encouraging. One of the directors, Wayne Wild was challenged with a high staff turnover (>20% p.a.) and was looking for a benefit that would attract and retain talent at WEC. He was convinced that Credit Union membership could be a huge benefit for his employees. He decided to change the way employees accessed Jubilee Tower Credit Union Services and introduced FairQuid Employee Benefit scheme. This innovative idea was a game changer as it made it easy and hassle-free for employees to get the loan they needed at a fair rate of interest. No need to save before they borrow and everything happens online in real time.

1 year after implementation the scheme has achieved its goal of improving staff retention above expectations. Over 130 employees have joined the scheme and staff turnover dropped to 4%, saving the business over £250,000+ in recruitment and associated replacement costs.

“It’s a win-win,” says Wild. “The employer wins by saving on retention and recruitment; staff win with low-cost borrowing. The only thing he changed was the interface and the result was a massive increase in employee participation.

Making a difference to your employees lives is not necessarily about new and quirky benefits, it’s about inspired HR managers caring about the real issues of their people and trying to make a real difference for them. The benefit package per se is not enough and must be integrated with a communication strategy designed to make employees aware of what is available to them and make sure to design a choice architecture that will favour high participation.

* Financial Well-being: The last taboo of the workplace? Why organisations cannot afford to ignore the financial health of their employees, Douglas Johnson-Poensgen, Barclay’s 2014

# Nudge, Improving decisions about health, wealth and happiness, Thaler & Sustein, Yale University Press, 2008.

^ A Credit union is a non-for-profit organisation that operates savings and loans account for its members. These organisations are fantastic because they provide loans at a fair rate of interest and all the profits are paid back to the members as dividends every year. Some Credit Unions have ties with local employers that they establish on their own or through FairQuid.