It sounds cynical, but however much your employee loves their job, a big motivating factor in coming to work is the financial stability they get from it.

They exchange forty or so hours of their week for a wage that allows them to rent or mortgage a home, purchase food, drive a car, and have access to other services, including leisure activities.

When there is a risk to their financial stability, staff are unlikely to be motivated, and their efficiency is likely to be affected. Small amounts of stress aren’t necessarily considered a bad thing. Pressure to meet deadlines and targets could propel employees to do their best (as long as it isn’t applied too harshly or maintained for an extended period), and, theoretically, financial incentives such as commission for salespeople are more effective if they are appreciated – or necessary. However, stress, induced by money worries or otherwise, is likely to have a negative effect on an employee’s state of mind whilst working.

Losing sleep over money

Almost half of UK employees are worrying about their financial situation – and 18% are losing sleep over it. Stress prompts the release of adrenaline and cortisol, two hormones which can cause significant harm throughout the body, affecting mood, memory, blood pressure, heart rate, and the immune system.

Employees can hardly be expected to perform at their best under such conditions: 1 in 20 staff have been absent from work an average of 4.2 days a year due to financial stress-induced illness, with 49% of stressed employees taking sick leave compared to 36% of those who aren’t as worried about money.

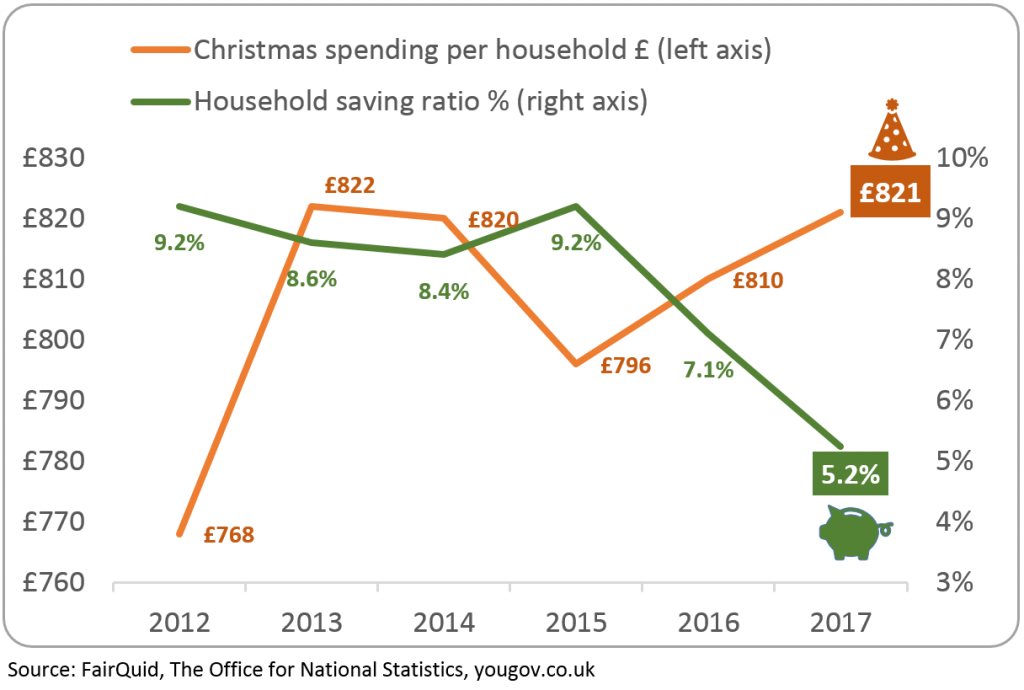

Alongside the run-up to Christmas, this time of year is probably one of the worst for employees’ stressing about money. It has a negative impact on productivity and can lead to time off sick or some looking for a new employer.

With the news that Carillion, the UK’s second-largest construction company, has gone into liquidation, threatening the jobs of its 20,000 UK workers, it’s evident that our current economic climate poses risks to financial security. Even organisations that are seemingly doing well can do more to prop their employees’ sense of financial well-being. Only you and your senior managers can take steps to ensuring your employees’ jobs are safe – but what about implementing other security nets?

Financial well-being services (that won’t cost a penny)

Many companies offer financial benefit packages – but employees are not always aware of what they can take advantage of. Bonuses are one benefit, but others might include investment opportunities, share schemes, and other ways of profiting from the success of the company.

One tool for promoting well-being at work is to make yourself an employer that is approachable, particularly when it’s a sensitive issue. Employees struggling with money might benefit from an advance on their wages, a loan, or asking for a wage increase; but often, they are embarrassed to broach the subject. Many people also believe that management will be unsympathetic to their concerns, with some even thinking that it could affect their prospects if they ask for more money.

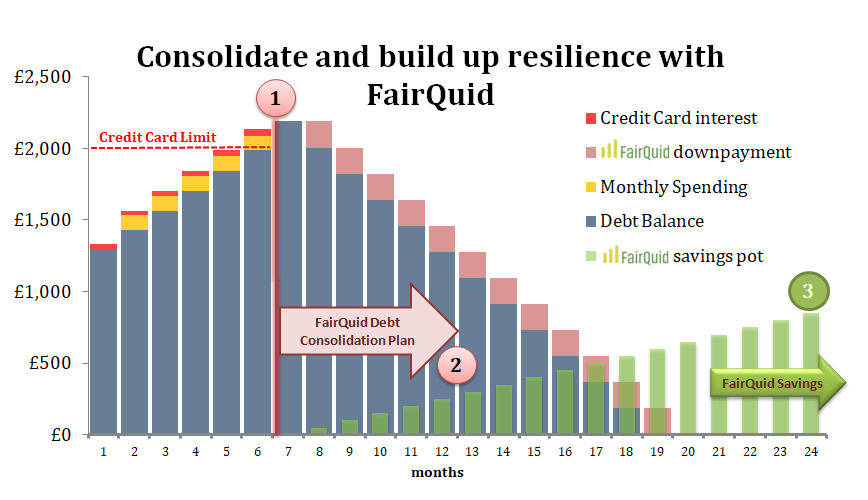

Even if you are unable to help, remember to remain sympathetic, and perhaps point them in the direction of alternatives, such as a FairQuid employee financial well-being savings or debt consolidation solution.

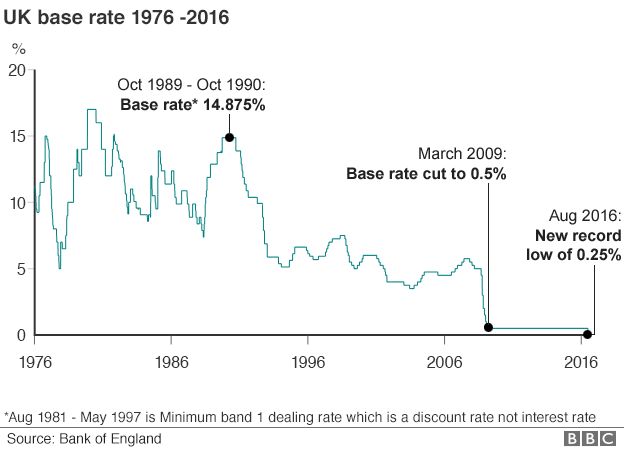

Inflation coupled with the stagnation of wage growth has seen a narrowing of disposable income. The first quarter of 2017 saw disposable income, adjusted by inflation, shrink by 0.4% – the greatest drop in almost three years. As households feel the pinch, they are more likely to rely on credit cards or turn to payday loans to fund their spending. With high interest and missed payment charges, the amount being paid back can quickly add up and be in excess of what was originally borrowed.

Saving for a “rainy day” has always been considered worthwhile: a few pounds every week can soon grow into a fund that can be dipped into in emergencies.

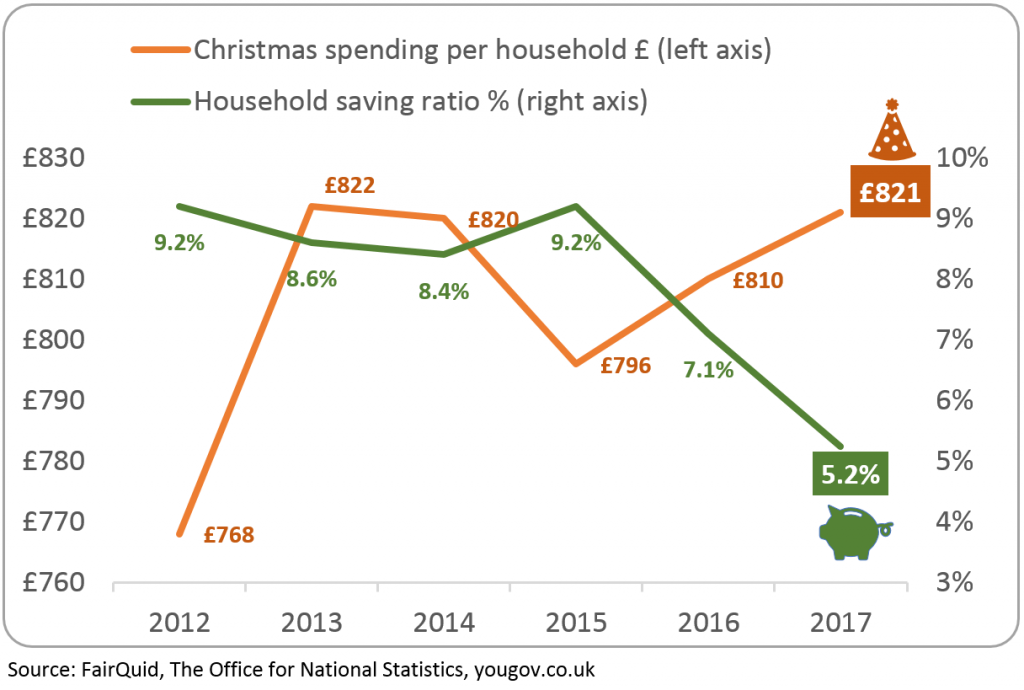

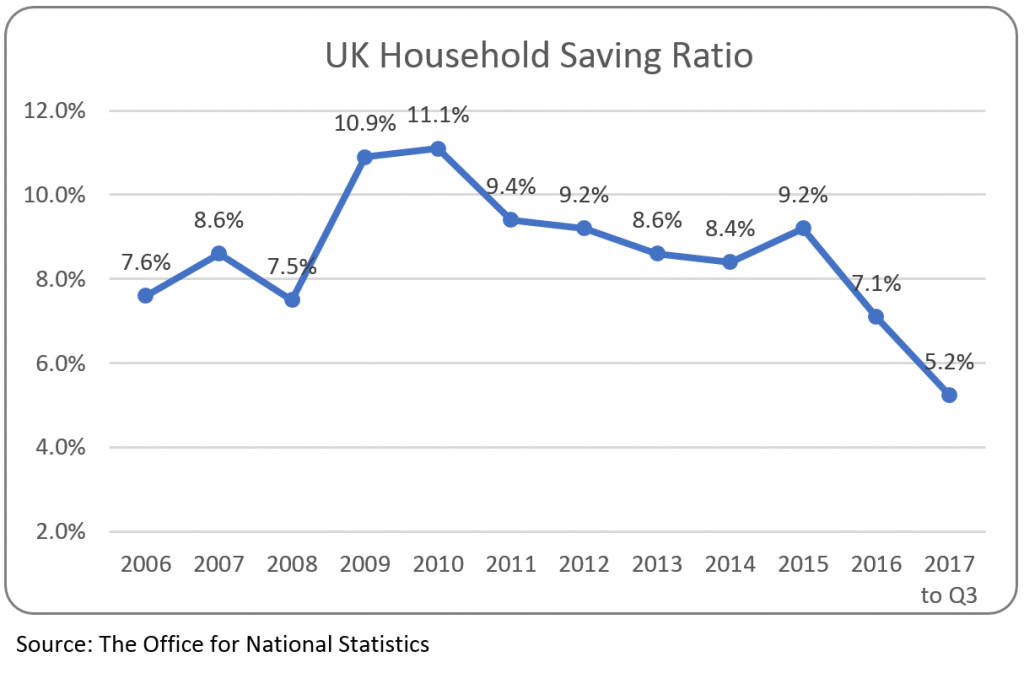

However, the fourth quarter of 2016 saw the lowest savings ratio since records began in 1963, falling sharply from 5.3% previously to 3.3%. The ratio, which represents how much of a household’s disposable income is set aside for saving, increased in 2017 back to 5.5% and standing at 5.2% in the latest reported quarter of Q3 2017 (see chart below). However, it is still falling short of previous years like 2015, which saw highs of 9.7%. It seems that British homes are struggling to set money aside from their disposable income.

A sensible, proactive solution

A FairQuid savings account, with partner Credit Unions, is designed for your employees. Rather than an employee taking money from their disposable income – what is left after bills, food, and rent is paid for – to put into their savings – the money is taken directly from their wage even before they receive it.

Instead of savings being relegated to “whatever’s left over” at the end of the month, it is the first outgoing, so it can never be spent, whether accidentally or on purpose. In fact, since the employee will never hold the total amount (that is, their wage including the savings), they are less likely to miss it.

With one cost already removed from their consideration, employees can budget more effectively with what is left over. And, since they are part of member-owned credit unions, participants can benefit from healthy dividends on their savings – so paying in also pays out.

Creating financial security is about more than creating more disposable income for your employees. Peace of mind contributes to a healthy body, a focussed mindset, and an overall happier outlook.

sources:

Financial Well-being: The last taboo of the workplace? – Barclays

Financial well-being: the employee view – CIPD