Breaking the Debt Trap through Financial Education

The United Kingdom is reeling under a personal debt crisis, unprecedented in its scale. There are a disturbing number of statistics on the financial fragility of UK household finances. There clearly is a pressing need to address this financial vulnerability. There seems to be...

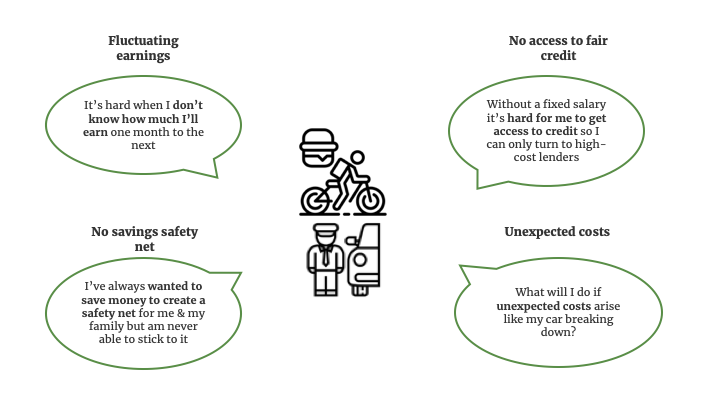

How to Address the Question of Financial Security for Gig Economy Workers?

The concept of work today is changing. One key trend making waves is the concept of freelance or contract-based work, also known as the gig economy. A departure from the full-time employment, a gig is a temporary work engagement where the worker is paid...

Don't let debt cast a shadow on the season to be jolly

It’s Christmas time again. For Mike, like many others, Christmas means being with family and friends as everyone enjoys the Christmas Day feast. The festival brings along with it the joy of giving gifts to loved ones, as well as going out with friends...

Government Aims To Address Debt Burden Through No Interest And Extended Repayment Schemes

According to the Office of National Statistics, for the first time in 30 years, UK households have collectively spent more than they have earned in 2017. Their total expenditure for the period came to on average £900 more than their income; thus pushing them into a financial deficit for the first time since the credit card...

Mind the Gap: Making Credit Fair for Everyone

Currently, there’s been a lot of attention on fighting inequality & boosting fairness in the workplace. From the #MeToo movement to gender pay gap, we have a lot of challenges to tackle. But there’s another inequality that needs to be addressed too. The...

A proactive approach to avoiding bad press in the Gig Economy

How to Save as you Borrow (as an Employee)

2 min read

Saving money isn’t easy. Especially when you’re juggling debts. Putting money aside for a rainy day isn’t something we, as a nation, are very good at anymore.

...Supporting Credit Unions through the #WorkNotWorry Campaign

Read time: 2 mins

Not enough savings and too much debt is a painfully stressful reality for millions of people across the UK. Credit unions are at the forefront of driving change and we, at FairQuid,...

Improve Your Employee Financial Wellbeing With Practical Solutions

Once known as a nation of savers, UK consumers are now more likely to use credit than savings for emergencies and other purchases such as holidays.

Savings are at the lowest levels since 1963. Over a...