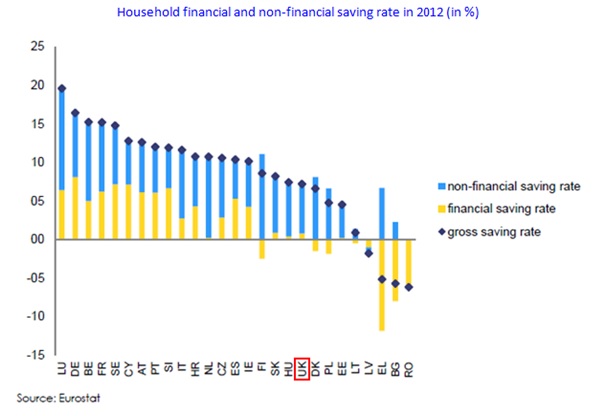

Vulnerability – historic low levels of savings in the UK

With interest rates at a historically low level (base rate reduced to 0.25% in summer 2016) spending helped the British economy to tackle the Brexit vote shock, and on national level provided a positive impetus for growth. This resulted in Britain becoming the fastest growing major economy in 2016.

Although we should welcome this positive news due to the consequent real wage increases and greater consumer confidence, leading to people spending again, the historically low rate of saving is a worry.

Consumer saving rates statistics are alarming – around 9.24m or 35% of households have no savings, while a further 13% have under £1,500. This is coupled with some of the highest debt levels, for example consumer credit stood at £7,118 per household in November 2016 (£515.37 more per household over the year)1.

This trend and the expected inflationary pressure for 2017 should make consumers cautious about their financial future, in particular the vulnerable low-earners who are more exposed to rising food prices/sudden increases in interest rates.

First Step– Paying off Rolling Credit

Changing one’s attitude towards debt can convert someone from a spender to a saver. The first step is to tackle current debt through future planning. Paying off rolling credits, such as credit cards and expensive overdrafts, are the first steps to becoming more disciplined with spending. Unless you can resist spending more each month than what you can repay the next month, credit cards are not for you. They are associated with high interest rates, excessive late payment fees and low minimum payments, ultimately designed to buy non-appreciating consumer assets and goods.

Debt Planning and Payment Control

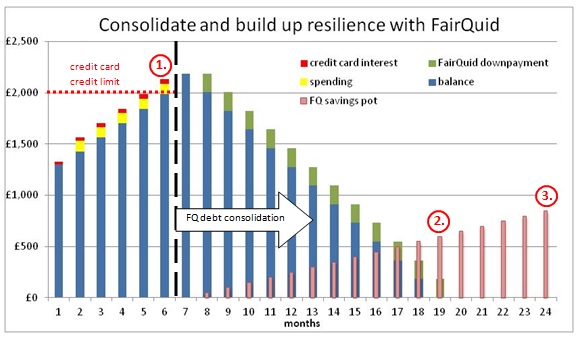

Coming up with a realistic payment plan and keeping control over it is essential to changing spending attitudes and protecting the borrowers from their partisan spending behaviour. For example, the FairQuid (FQ) payroll deduction scheme allows both: planning by assessing the borrowers’ affordability based on their verified net income and monthly expenses, and controlling finances through the deduction of debt repayments from the borrowers’ regular payroll, thus ensuring the debt is being repaid before the money even hits the individual’s bank account for active spending.

The chart below demonstrates how this payment plan would work for a typical customer.

In absence of a controlled payment plan, spending overshoots at six months by using credit card or overdraft (1.).

If then a new FairQuid payment plan is set-up with simultaneous saving deductions in conjunction with the fixed repayment plan, then 12 months later (at month 19) the accumulated credit card balance would not just be repaid, but a healthy savings cushion for unexpected life events in the future and the behavioural change of regular saving is also in place (2.).

The savings can continue even after the debt payment plan, which improves the resilience further (3.).

Start Investing for the Future

In addition to planning and controlling our existing debt, educating ourselves to the advantages of regular savings is vital. At a minimum, one should aim to have up to 2 weeks of their wages or £1,000 in savings for unexpected expenses. Building up some resilience towards sudden turbulences in the future will help us to survive stressful periods in life. Our Credit Union partners require borrowers to save on a regular basis, so while deleveraging their existing debt through debt consolidation, they start to feel the safety provided by an accumulated savings pot.

At FairQuid we believe that creating a custom solution for financial planning and control for employees can help in reducing the overall debt in the UK society. By building a platform which allows for employees to go through an affordability and expense check process, setting-up a savings plan and ensuring the deductions happen directly through their payroll, allows for debt consolidation and guiding people towards a more responsible way of spending.

1Source: http://themoneycharity.org.uk