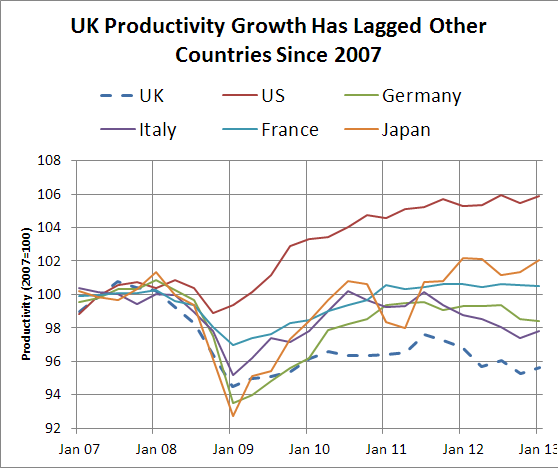

Wages are not rising as fast as living expenses. Growth is slow, and companies are, understandably, hesitant to increase payroll costs. At the same time, employees – consumers – are borrowing more than ever and savings are at a record low.

This isn’t some scene setting exercise for an article in The Economist. Unfortunately, this is the economic reality of Brexit Britain.

Retailers need consumers to keep spending, So do service companies and house builders. Banks are keen they keep spending too, but all of this means it’s easier to borrow money than save.

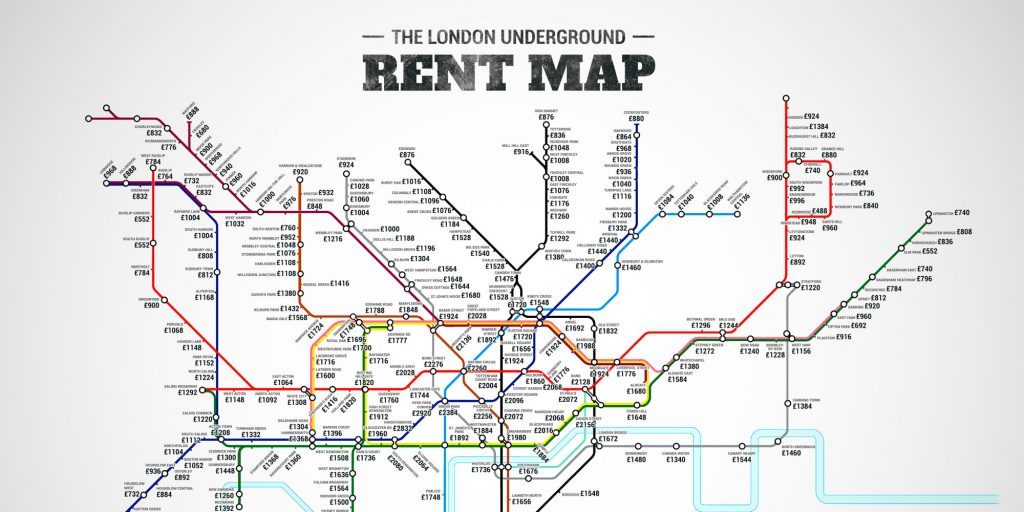

At the same time, the cost of living – inflation – keeps increasing, up 2.7% in May 2017 – from 2.6% in April, according to The Consumer Prices Index (CPIH), which can’t keep pace with salary increases. Again, forcing consumers to borrow or dip into savings when costs increase or they need to spend more.

With the Summer behind us and Christmas on the horizon, most parents will be feeling an acute pain in the wallet or when the next credit card statement hits.

Savings Recommendations vs Reality

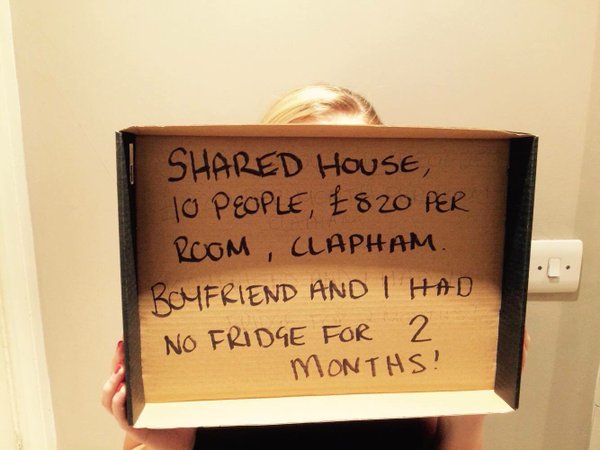

Debt charity, StepChange, recommend most people have at least £1000 set aside in savings. For one in four families in the UK, those that earn less than £1,500 per month (after tax), that simply isn’t realistic or practical. In reality, savings amongst low earners is usually around £95 – an amount that can be easily wiped out when an unexpected bill hits or one month is more expensive than another, such as during the Summer or Christmas. Even that £1000 figure is too high for 70% of adults in the UK.

Saving money is not easy for employees who live paycheque to paycheque.

For most families, even those with two paycheques and working tax credits or another government benefit, getting to that £1000 in savings can be a struggle. Once money comes in, it’s usually allocated to something – mortgage/rent, bills, food shops, kids, everyday money and the occasional treat. Savings is a nice to have, but when credit is cheap and easy to access, not a must-have, at least not every month.

An alternative: A benefit employers can offer employees?

Companies can offer staff an alternative solution.

An employee benefit Savings account, with the amount an employee wants to save automatically deducted from salary payments. Instead of staff struggling to find money to put aside after they’ve been paid, with automatic deductions before the funds hit their bank accounts, they can adjust personal budgets whilst knowing a savings pot exists they can tap into when needed, making it far easier to start saving.

Every month, your team could have money going into savings accounts, putting aside a little extra that grows with dividends, from our Credit Union partners. At the same time, if any of your team need to borrow from a credit union, the interest they pay goes back into the pot that pays out dividends to themselves and everyone else with a savings account.

Similar to automatic enrolment, except this is a voluntary scheme and one that employers don’t need to make contributions towards. Staff control their savings, including withdrawals anytime they need.

Not only will employees gradually build up savings, but for employers, you can rest easy knowing:

- Workplace stress levels would reduce. Money is one of the main reasons behind absenteeism, stress-related illnesses, poor engagement at work and staff looking for new jobs.

- Mental health at work will improve. Knowing that staff have savings, money in the bank will reduce the impact of stress, making your team more engaged, focused and able to hit targets.

- As a workplace benefit, savings accounts are one of the most effective, practical, financial benefits you can offer that doesn’t cost the company money. Now is the perfect time to introduce workplace savings accounts as an employee benefit.

As an employer, you can do something about these issues (whilst also ensuring your staff are more productive and engaged) – thanks to FairQuid Credit Union savings accounts. Best of all, these won’t cost your business a penny. Find out more today.