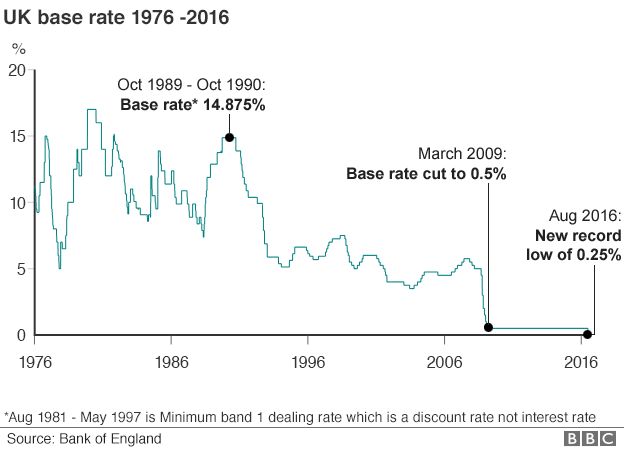

In November 2017, the Bank of England announced that it was raising its base interest rate for the first time in a decade, from the record low 0.25% to 0.5%.

Will it help you save more?

When it comes to savings, you’re not going to see a massive influx of extra savings interest, but anything extra always helps. With most ISA interest rates hovering around the 2% mark, we’ll probably see an extra 0.25% return – another £2.50 per £1,000 each year, or £22.50 instead of £20.

How Will It Cost You Money?

This depends on the type of credit you already have and whether you have a fixed or variable return rate.

Most common, smaller types of debt – such as credit cards, store cards, and unsecured personal loans – have fixed terms for repayments set out when you sign up, which won’t be affected by the new base rate. If there are going to be interest rate changes, the company will contact you directly to make you aware of what these changes are and when they will take effect.

How Will Your Mortgage Be Affected?

With a mortgage being possibly the biggest monthly outgoing, this is the biggest concern for most people. How your mortgage repayments are affected depends on the type of mortgage you took out:

Fixed rates

This offers a set sum to be paid every month for a determined period (one, two, three, five, or ten years). These often have the most expensive rates and fees since they offer stability and reliability: However much the Bank of England’s base rate varies, you will never pay more (or less) than agreed.

Your fixed rate mortgage should not be affected by the base rate change. However, once the period has expired, you will be subject to the lender’s SVR (Standard Variable Rate), which is affected by the base rate, unless you take up a new mortgage deal.

Standard variable rates

These are interest rates set by the lender and are subject to change at any time. They loosely follow the Bank of England’s base rate but don’t reflect them exactly: For example, with the base rate increase of 0.25%, your lender could increase standard variable rates by 0.5%.

Tracker rates

These are directly correlated with a base rate, “tracking” at a certain level above. This is usually, but not necessarily, the Bank of England base rate.

For example, if you rate is tracked as 2% above the Bank of England base rate, it has just risen from 2.25% to 2.5%. However, some lenders use other base rates, like the LIBOR interest rate, which is higher than the Bank of England rate, due to the higher risk. Like fixed rates, tracker rates are normally only in place for a few years, and then your mortgage will revert to the (typically higher) standard variable rates.

Capped Rates

These can be either fixed, standard variable, or tracker, and react accordingly (or not) with the base rate, but they come with a guarantee that they will never exceed a certain amount. As long as this cap is not being exceeded by the 0.5% increase, then your rates will still fluctuate (or not, depending on if your rate is fixed or variable) with the base rate.

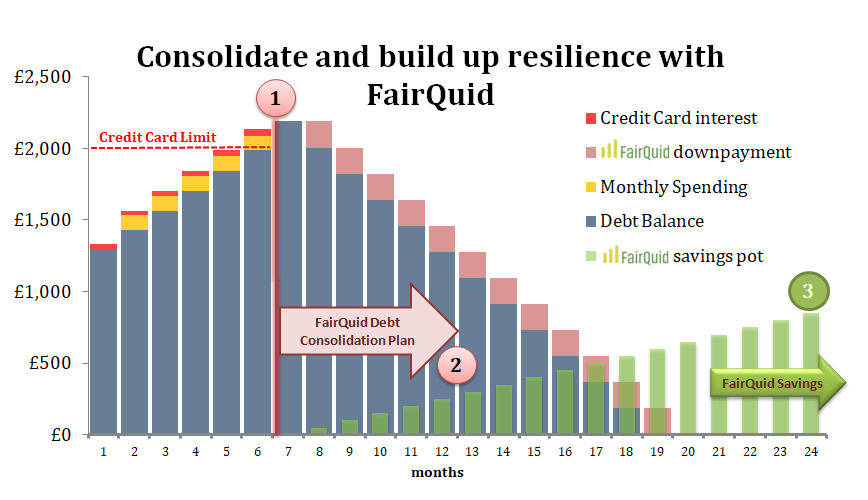

Time to start saving and reduce debts?

With savings rates back up and interest rates on the increase, and more rises expected in the future, 2018 could be the year to start saving and clear away debt before the base rate gets any higher. And if you want to get rid of all your debts, you could consolidate them and reduce your monthly payments, whilst paying into a savings account at the same time. Already debt free but want to take advantage of a savings account? Put a little aside each month straight from your salary payments and take control of your savings.